All he said was that, while the report was encouraging, they need substantially more evidence to believe that inflation has turned a corner. The omission was curious, more so because we just got a second consecutive inflation report that surprised us to the downside.

Powell mentioned this in comments he made a couple of weeks ago but didn’t mention it again in his post-FOMC meeting press conference. Fed officials will likely start thinking about balance again: the risk of tightening too much vs. Consequently, the over-arching question on investors’ minds across the year was how quickly the Fed would raise rates, and how high they would go. The Fed’s singular focus was to ensure they did more than “enough” to lower inflation. As a result, we saw the most aggressive monetary policy tightening cycle in four decades as the Federal Reserve (Fed) looked to get on top of inflation. The conversation in 2022 revolved around inflation, which surged to the highest level since 1981. The shift: From how fast and how high to how long There’s no reason to think we won’t see more revisions if the data cooperates. If you look back at the previous chart, we’ve seen significant shifts in rate expectations just over the course of this year.

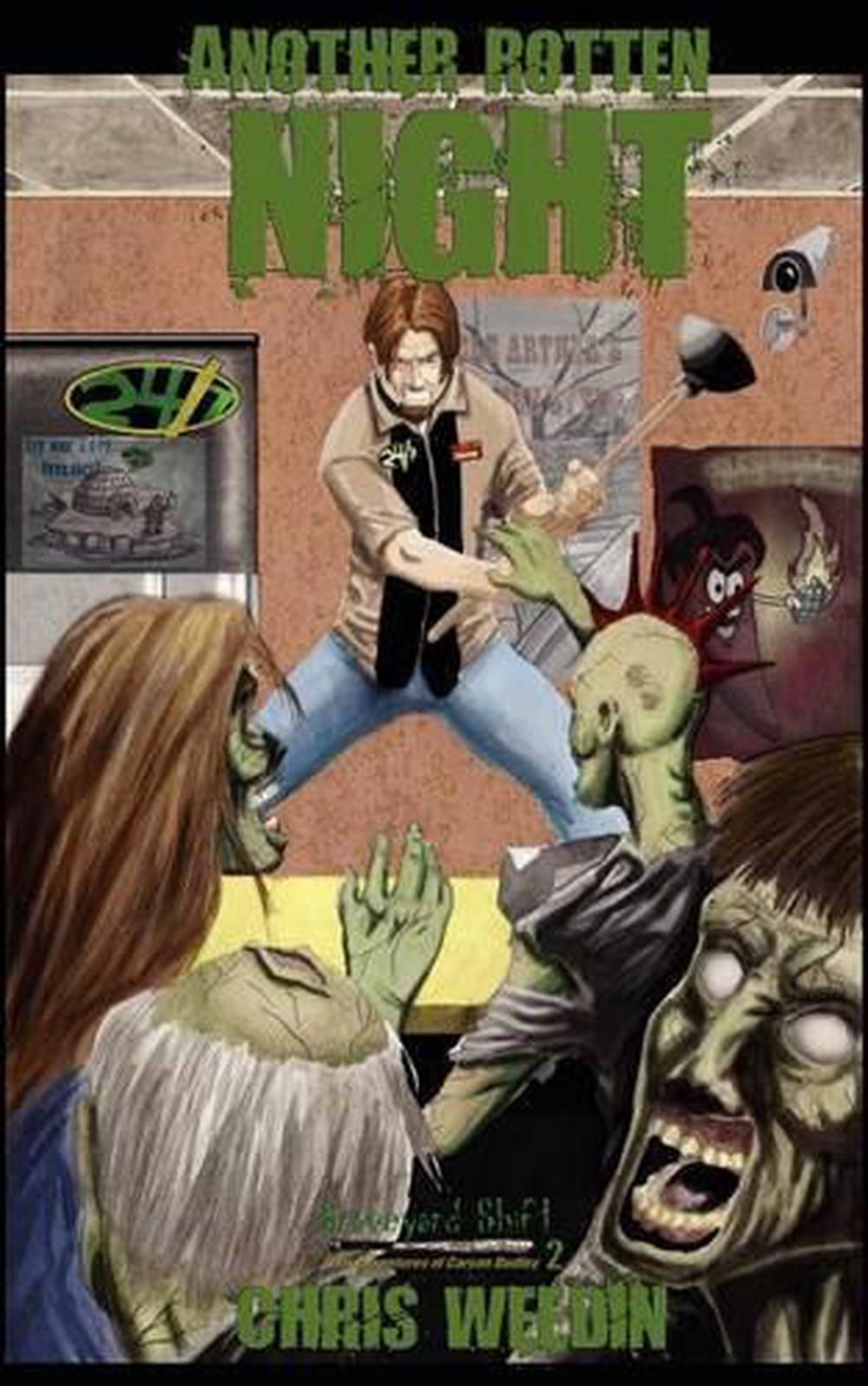

Shift carson update#

Before their March meeting (when they update the projections again), we have three more inflation reports, three employment reports, and an employment cost index report (which is a preferred gauge of wage growth). has never experienced a 1% rise in the unemployment rate outside of a recession.īut if you notice, I said “not so good news” instead of “bad news.” Powell pointed out that these are members’ best estimates “as of today,” but that could change as new data comes in. While Fed Chair Powell was careful to say that they don’t believe these forecasts qualify as a recession, keep in mind that the U.S. They revised core inflation higher, from 3.1% to 3.5% (2023).They revised the unemployment rate higher, from 4.4% to 4.6% (about 1% point higher than where it is now).They revised economic growth lower, from 1.2% to 0.5% (2023).The not-so-good news: They also provided revised estimates for the economy, which wasn’t great. At the end of 2021, they estimated rates to peak at 2.1% and then continuously shifted those up by 0.6% – 1% increments every three months. The estimate revisions are nowhere as large as what we had seen earlier this year. What’s important is that the end of the rate hike cycle is near.

0 kommentar(er)

0 kommentar(er)